One of the constants we are facing here in the San Diego Real Estate market over the last couple of years, are the historically low levels of inventory. And in the last couple of months with rising inflation and 30 year mortgages rates fluctuating from 4.5-6% we are starting to see a substantial shift in the real estate market, starting with the impact to buyer demand.

The number of homes sold in July 2022 dropped by 19.7% to the month prior which is pretty substantial decline given the fact that mortgage rates have seen a slight improvement to the month prior. This indicates other factors such as inflation, recession, stock market volatility and overall concerns for the future are having an impact on buyer demand. Real estate is cyclical here in San Diego, and this time of year we historically see 3500 homes sold in the month of July, which means July 2022 was down 35% which is one of the lowest numbers we would normally see this time of year.

Pending home sales were slightly down to the month prior, with the biggest drop-off having occurred a few months earlier from May to June. This indicates that not much will change in buyer demand in the upcoming months.

As a result we are seeing home prices come down – that is to say, homes that are currently on the market are seeing price reductions. This is because when they were listed for sale, they were priced based on comparable sales from the month or two before – when rates were lower and demand was higher. The higher interest rates have impacted affordability and demand for homebuyers and so those homeowners who priced aggressively have had the choice to either lower their price, stay on the market for longer or choose not to sell.

Median sales price in July 2022 was $810,00, which is down 3% to the prior month of $835,000 and down 5.3% to May 2022 where we saw median sales price peak at $855,000. Which can seem alarming and cause some concerns, however in looking at last year’s numbers of $749,000, the median sales price is still up 8.1% to last year. What we are seeing is price appreciation slowing down to single digit increases which is necessary to avoid a housing bubble – we couldn’t have sustained the double digit price growth year over year that we saw in the last two years for the long term.

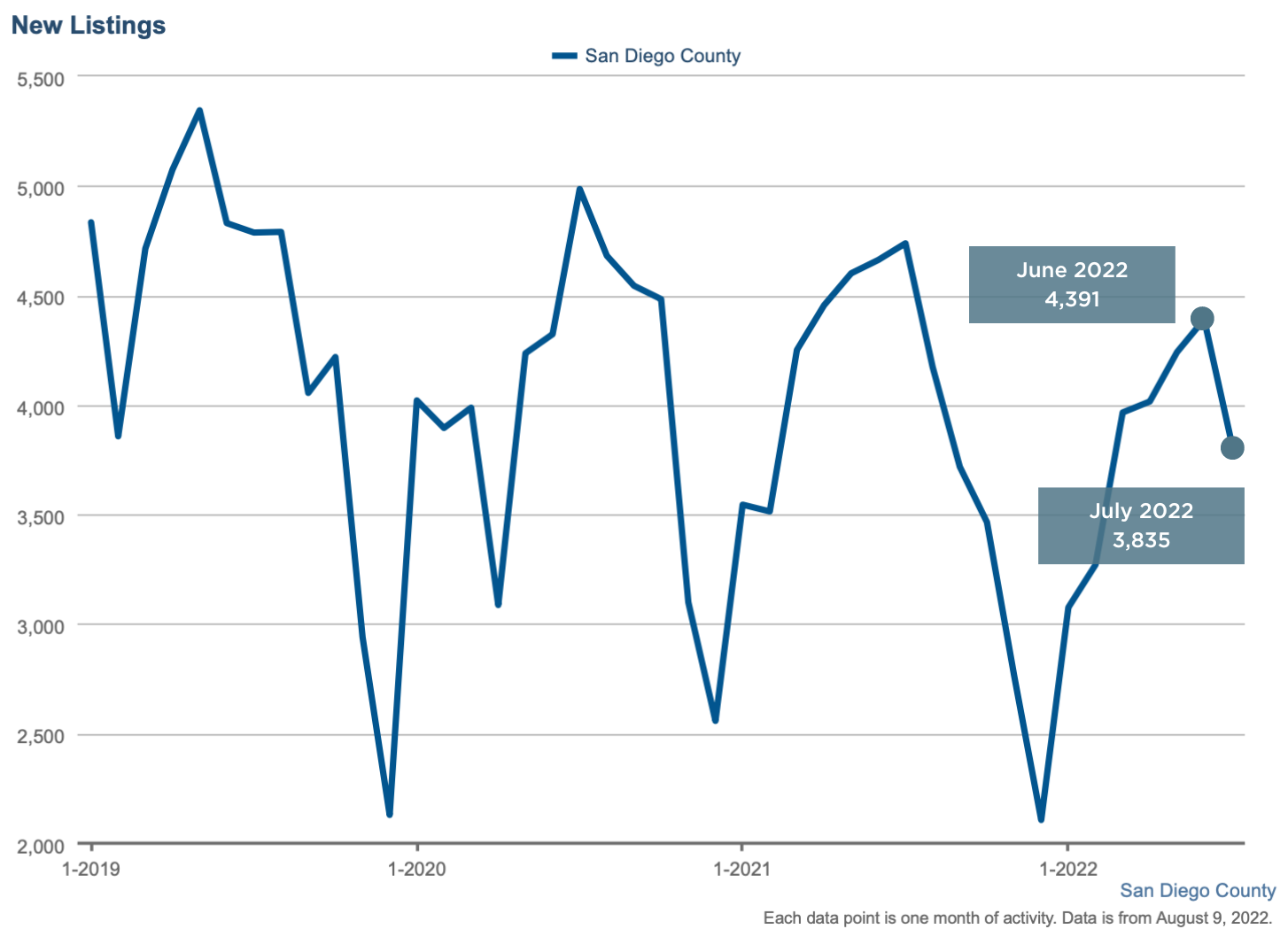

In conjunction with drop off in buyer demand, and slight price reductions the number of new listings has dropped 12.7% from the month prior as potential home sellers decide to not put their home on market given the current market conditions.

Total number of active listings is now at 5,226 homes for sale in the month of July, which is a 5.7% increase to the month prior predominantly driven by the drop off in buyer demand. This represents 1.8 months of supply which means we are still in a sellers market, but moving into a much healthier and balanced real estate market, where the buyers have an opportunity to negotiate on price, request for repairs and a number of other favorable terms.

What does this mean?

The truth is, American homeowners currently have record levels of home equity. A lot of the news about the real estate market sounds unfavorable, but it’s really a matter of inflated expectations. Over the last two years, homeowners could expect to list their homes for more than the recent comparable sales and get many multiple offers within days of listing with homebuyers eager to beat out their competitors by waiving contingencies so they could take advantage of the next-to-free mortgage pre-approval. Today, we have a better idea of what to expect when selling a home – if your home is priced accurately, it will still sell to the right buyer in a reasonable amount of time – there may be more negotiation involved but when you work with a professional, both sides will reach a win-win agreement.

If you’re considering moving, right now is still a great time to sell your home and take advantage of the equity you’ve built over the last several years. If you are prepared to buy and plan to be in your home for more than a few years, it’s a good time to buy so long as you make smart money moves – like being sure to examine as many loan scenarios as possible and purchasing properties with potential upside in value.

“The old saying in real estate is: the best time to buy a house is 15 years ago, and the second best time is today.” – Rick Sharga, EVP of Market Intelligence at ATTOM. For folks considering a home to own for a long time, this is true – they should worry far less about “timing the market” and focus more on how much home they can comfortably afford. In their case, the interest rate is only a driver of affordability – as they say, “date the rate, marry the house.” Mortgages can always be refinanced so if you’re ready to buy a home, secure the best rate available to you today, and keep an eye on how rates change. When the rates are more favorable and the refinance costs pencil out, take advantage of the moment to lower your housing costs.

Whether the same will be true in six months is anyone’s guess – there is no crystal ball that helps to predict the complex events that can impact the real estate market.

As always, we will be here to continue to provide you with updates about the housing market and answer any and all of your questions. Feel free to reach out to us anytime.